A life changing event comes when we are not looking.Inspired and IdleHearts

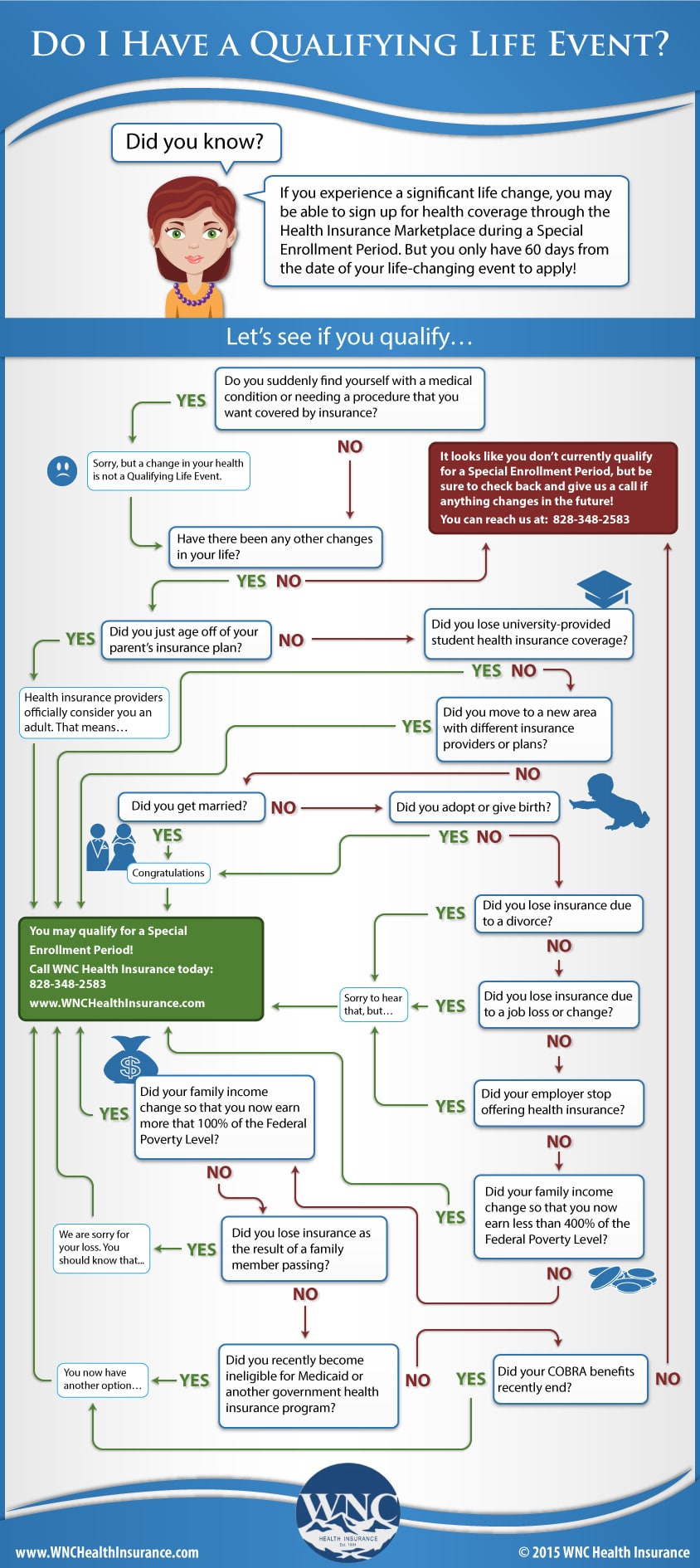

For job-based plans, those events may include getting married, having a baby and losing coverage under your spouse's plan. For the Health Insurance Marketplace, those events can also include moving to a new zip code and other changes. Often you'll need to document those changes (for instance, with a marriage license).

How to Choose the Right Event Insurance Policy for Your Needs Branco Insurance Group

Loss of a loved one. If the person carrying your health insurance (such as a spouse or parent) or a person covered by your plan dies, this is a qualifying life event. You can make changes to your plan outside of annual open enrollment. You will often be required to provide a copy of a death certificate within 30 to 60 days of the loss.

A Life Changing Event Part 2 Heidi St. John

In many cases, that starts in November and runs through December or January. If it's not the open enrollment period, you can only sign up or change your insurance plan if you've had a qualifying life event. After a qualifying life event, you don't want to procrastinate on signing up for your new insurance plan.

Is Pregnancy A Life Changing Event For Insurance PregnancyWalls

Loss of health insurance. Losing coverage due to a job loss. Losing Medicare, Medicaid or CHIP eligibility. Losing coverage on your parent's plan when you turn 26. Change in household. Marriage.

HOME • My Patriot Marketplace

If you've experienced a qualifying life event, check your plan materials, contact your employer or call the phone number on your member ID card for help. Qualifying life events include (but are not necessarily limited to): 1. Getting married. Getting divorced. Having or adopting a baby. Death of someone who shares your health plan.

What Employers Need to Know About a Qualifying Life Event

Join us for insightful debate and presentations on the future of mortality and longevity risk. The Life ILS Conference returns to London on Tuesday, May 21st , 2024. Hosted by Life Risk News, this must-attend conference will bring industry peers together to cover the latest market insights, news and trends in the Life ILS space.

404 Not Found Life Changing Events

A qualifying life event starts a special enrollment period during which you can enroll in a new health insurance plan or make changes outside of open enrollment. Qualifying life events for health insurance include having a baby, getting married or a change in employment. If you have an individual health insurance plan through the Affordable.

Life Insurance Changing Times, Changing Needs Wilkinson Wealth Management, LLC

Life events or changes may open a Special Enrollment Period for you.. Open Enrollment is over, but you may still be able to get or change health coverage for this year. Get Answers. Search.. Loss of health insurance, like job-based or individual coverage;

Qualifying Life Events for Health Insurance

Qualifying life events allow you to purchase health insurance outside the open enrollment period. Qualifying events include marriage, divorce, the birth of a child, loss of existing coverage, and changes in household or residency. Updating health insurance after a qualifying life event often requires providing documentation to prove eligibility.

Financial Strategies for LifeChanging Events Mariner Wealth Advisors

A qualifying event is any life change that affects your health insurance coverage, such as losing your job, getting married or divorced, or having a new baby. During a qualifying event, you have a 60-day window to enroll in a new health insurance plan, even if it's outside of the open enrollment period.

A Life Changing Event PDF

QLEs automatically grant you a 60-day Special Enrollment Period to enroll in health insurance during any time of the year. Your Qualifying Life Event (QLE) immediately begins a Special Enrollment Period (SEP) once it occurs. When you enter that Special Enrollment Period, you or your family can pick a new comprehensive health plan without penalty.

Insurance Life Changing Event Thismylife Lovenhate

A qualifying life event (QLE) is an event that changes your family or health insurance situation and qualifies you for a Special Enrollment Period. Special Enrollment Periods are generally the only way to change your health insurance plan outside of the annual Open Enrollment period — the 45-day period that starts in the fall for a plan that begins the following year.

Special Enrollment Periods Give You Coverage After a Life Change ThinkHealth

Qualifying life event (QLE) A change in your situation — like getting married, having a baby, or losing health coverage — that can make you eligible for a Special Enrollment Period, allowing you to enroll in health insurance outside the yearly Open Enrollment Period. There are 4 basic types of qualifying life events.

Special Enrollment Period Solid Health Insurance

A qualifying life event is when you experience a change in your life or financial situation in which you lose or need to change your health insurance coverage. As a result of a qualifying life event, you're eligible for a Special Enrollment Period, allowing you to apply for health insurance outside the annual Open Enrollment Period.

Qualifying Life Event Special Enrollment Period Infographic

The length of time to select a plan usually is only 30 days in the employer market. A qualifying life event is an event that triggers an open enrollment window for an individual or family to purchase health insurance outside of the scheduled open enrollment periods. Includes the birth or adoption of a child, marriage or divorce, or the loss of.

Impact Life Blog Attention!! Life Changing Event Sets To Take Place

But if you enroll under the general open enrollment period, your new coverage won't be effective until January 1. 5. Divorce (in some state-run exchanges) If you lose your existing health insurance because of a divorce, you qualify for a special open enrollment based on the loss of coverage rule discussed above.

- Como Bloquear Ventanas Emergentes En Google En El Móvil

- Te Deseo Un Feliz Sabado

- 7 Days To Die Construir Una Granja

- 0062 Indicativo De Que Pais

- Piernas Y Gluteos De Acero

- Capotas Cubre Orejas Perros Aliexpress

- Discovery 2 Heater Blower Not Working

- Guardar Cápsulas Café Dolce Gusto

- How Much Is An Air Conditioning Unit

- Hoy Dia 16 De Agosto Horario De Torneo Detenis Cicmcinati