Debt to Equity Ratio Calculation, Interpretation, Pros & Cons

The company's revenue growth of 13.91% exceeds the industry average of 13.37%,. The debt-to-equity (D/E) ratio provides insights into the proportion of debt a company has in relation to its.

Netflix (NFLX) Debt to Equity Ratio (20132023) History

Industry Name: Number of firms: Book Debt to Capital: Market Debt to Capital (Unadjusted). (Unadjusted) Market D/E (unadjusted) Market Debt to Capital (adjusted for leases) Market D/E (adjusted for leases) Interest Coverage Ratio: Debt to EBITDA: Effective tax rate: Institutional Holdings: Std dev in Stock Prices: EBITDA/EV: Net PP&E/Total.

What Is DebttoEquity Ratio? Definition and Guide (2023)

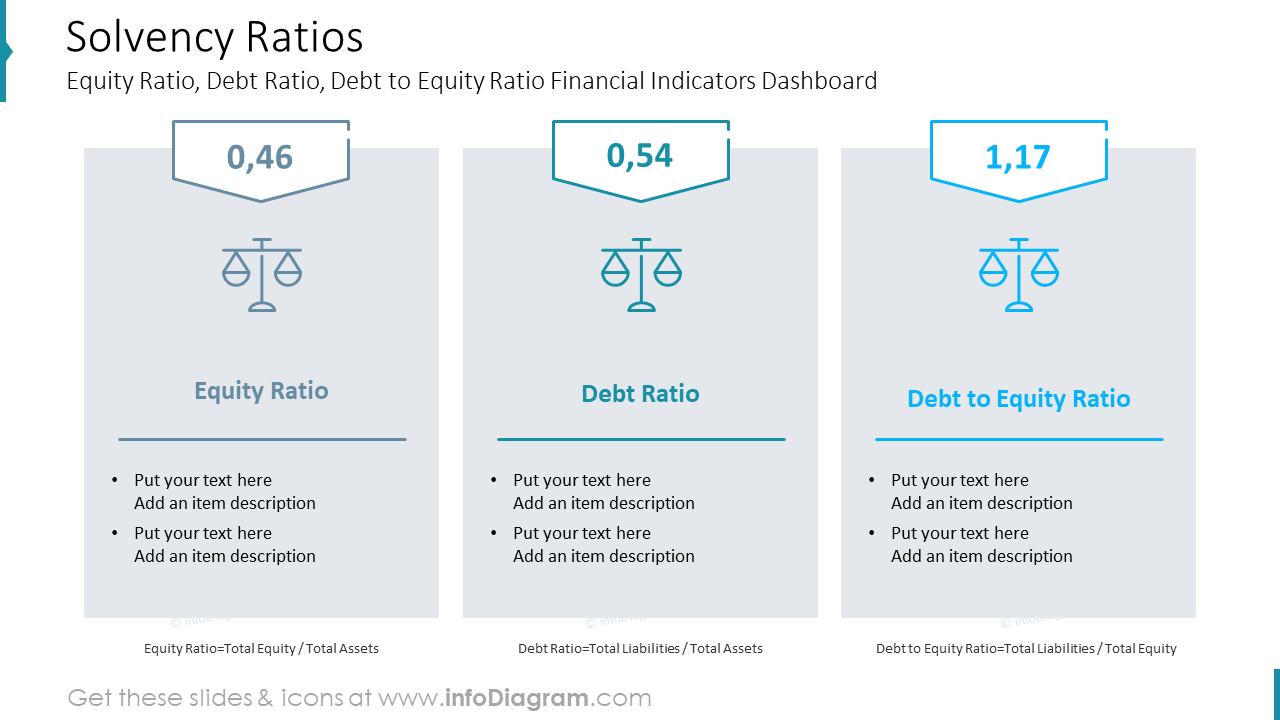

A high debt to equity ratio can bring down the company's WACC ( Weighted Average Cost of Capital). It is the capital that the company has to pay to fund its assets.. Debt to Equity Ratio by Industry. S. No. Industry Name Debt to Equity Ratio; A: Basic Materials: 0.5066: 1: Agricultural Inputs: 0.3804: 2: Aluminum: 0.6782: 3: Building.

Debt to Equity Ratio Calculator Flow Capital

With a Price to Book ratio of 15.7, which is 3.63x the industry average,. The debt-to-equity (D/E) ratio measures the financial leverage of a company by evaluating its debt relative to its equity.

Debt to Equity Ratio, Demystified

Despite debt repayement of -1.54%, in 4 Q 2023 ,Total Debt to Equity detoriated to 0.65 in the 4 Q 2023, a new Industry high. Within Consumer Discretionary sector 2 other industries have achieved lower Debt to Equity Ratio. Debt to Equity Ratio total ranking has contracted relative to the preceding quarter from 36 to 43.

Assets and Total Debt/Equity Ratio (€/1000) Download Scientific Diagram

The Price to Sales ratio of 3.45, which is 1.55x the industry average,. By considering the Debt-to-Equity ratio, Cisco Systems can be compared to its top 4 peers, leading to the following.

What is the DebttoEquity Ratio BDC.ca

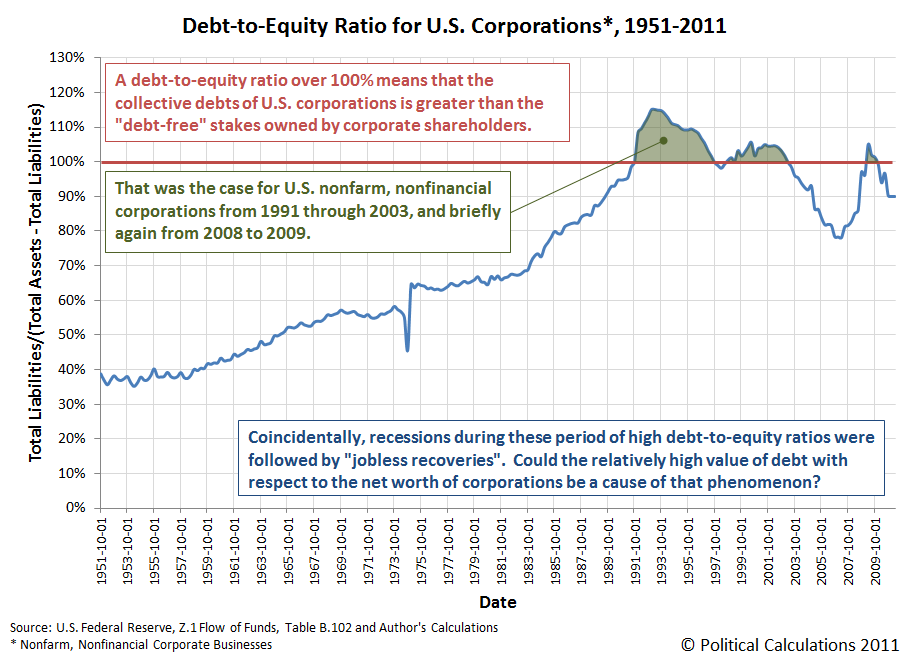

Debt-to-equity ratio - breakdown by industry. Debt-to-equity ratio (D/E) is a financial ratio that indicates the relative amount of a company's equity and debt used to finance its assets. Calculation: Liabilities / Equity. More about debt-to-equity ratio . Number of U.S. listed companies included in the calculation: 3617 (year 2023).

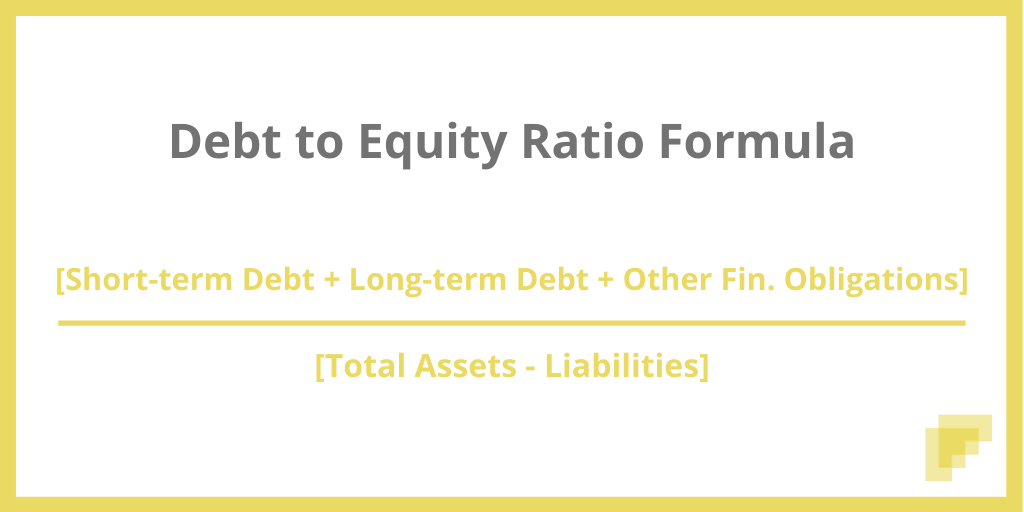

Debt to Equity Ratio Formula How to Perform D/E Ratio? (Step by Step)

A higher D/E ratio indicates that a company is financed more by debt than it is by its wholly-owned funds. Depending on the industry, a high D/E ratio can indicate a company that is riskier. D/E.

Debt To Equity Ratio By Industry Management And Leadership

The debt-to-equity ratio measures a company's financial health and ability to repay its creditors.. investors and analysts prefer to see higher returns on equity. The industry average was 15.86.

Table showing the Debt/Equity Ratio Download Table

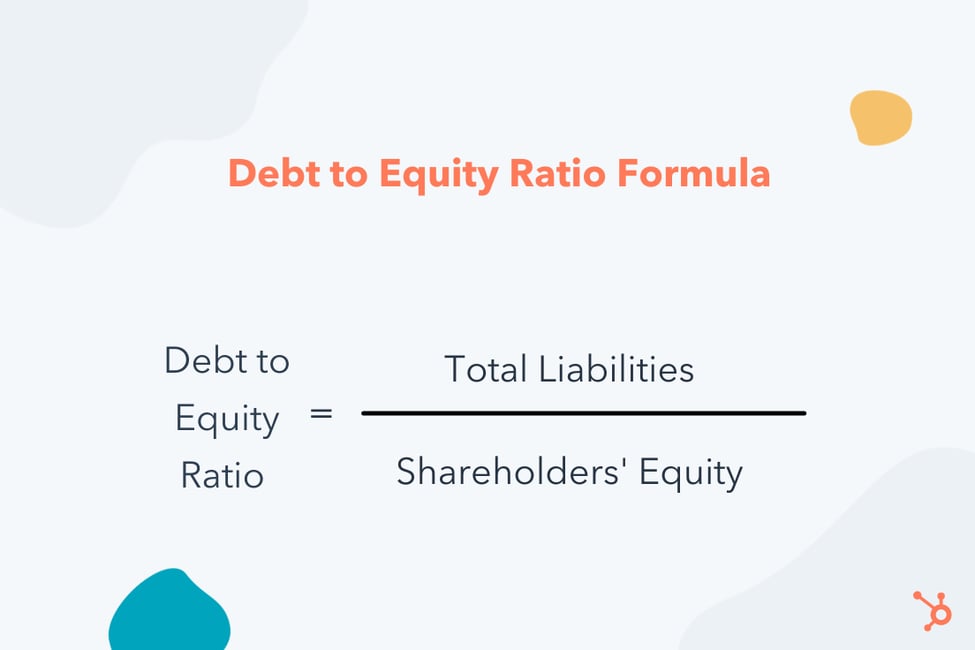

The debt-to-equity ratio (also known as the "D/E ratio") is the measurement between a company's total debt and total equity. In other words, the debt-to-equity ratio tells you how much debt a company uses to finance its operations. For instance, if a company has a debt-to-equity ratio of 1.5, then it has $1.5 of debt for every $1 of equity.

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

DebttoEquity (D/E) Ratio Definition and Formula

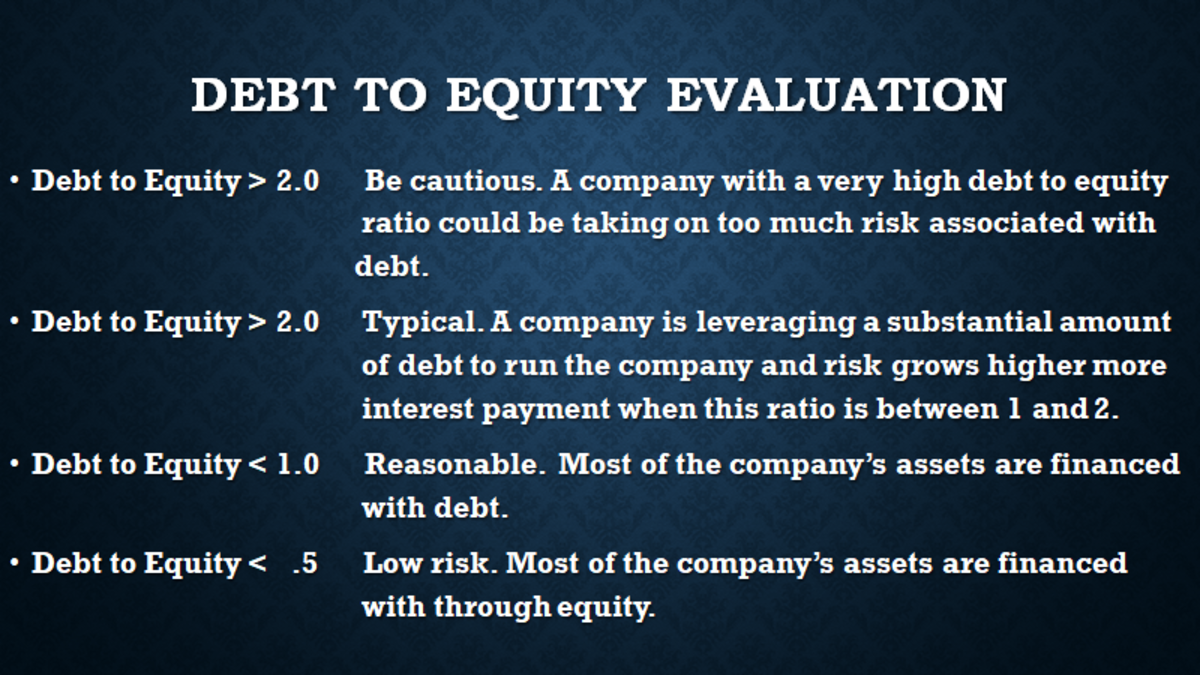

The debt-to-equity ratio is calculated by dividing a corporation's total liabilities by its shareholder equity. The optimal D/E ratio varies by industry, but it should not be above a level of 2.0.

Debt To Equity Ratio

Published by Statista Research Department , Nov 23, 2023. In the second quarter of 2023, the debt to equity ratio in the United States amounted to 79 percent. Debt to equity ratio explained. The.

:max_bytes(150000):strip_icc()/debtequityratio_final-86f5e125b5a3459db4c19855481f4fc6.png)

DebttoEquity (D/E) Ratio Formula and How to Interpret It

Average excess returns (return on invested capital minus cost of capital, return on equity minus cost of equity), economic value added and equity economic value added by industry sector.. Market debt ratio, the effective tax rate (tax benefit), insider holdings (discipline), variance in operating income (bankruptcy risk) and fixed assets to.

Solvency Ratios Equity Ratio, Debt Ratio, Debt to Equity Ratio Financial Indicators Dashboard

12. Based on the information in the table above, the REIT - Mortgage industry has the highest average debt to equity ratio of 3.13, followed by Resorts & Casinos at 2.4. In contrast, the Other Precious Metals & Mining industry has the lowest average debt to equity ratio of 0.04, followed by the Gold industry at 0.17.

How to Calculate the DebttoEquity Ratio ToughNickel

The debt-to-equity (D/E) ratio shows how much debt, relative to equity, a company is using to finance its operations. This guide includes the formula and examples.. it's useful to know that the average D/E varies considerably by industry. As examples, here are some industry average D/E ratios for 2021 : Apparel & accessories stores: 1.66.

Debt to Equity Ratio by Industry Eqvista

All Industries: Average Industry Financial Ratios for U.S. Listed Companies. These ratios are calculated for publicly traded U.S. companies that submit financial statements to the SEC. Hover over the ratio value in the table to see the exact number of companies included in the calculation.

- Serie El Descubrimiento De Las Brujas Temporada 3

- Coliseo Foro Y Palatino Arena De Gladiadores

- Del Aeropuerto De Bolonia Al Centro

- Diferencia Flor Melocotonero Almendro Cerezo

- Muebles De Ocasion En Sevilla

- Salario De Un Diseñador Grafico En España

- Cual Es El Edificio Mas Alto De Ny

- Gradinata Non Numerata Arena Di Verona

- Cerraduras De Cofres De Herramientas

- Parrillada Argentina Rua San Leandro